Life Insurance in and around Eugene

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

It’s common for young people to assume that life insurance is something to think about on down the road. Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Eugene, OR, friends and neighbors of all ages already have State Farm life insurance!

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Agent Sam Krier, At Your Service

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With an insurance policy from State Farm, you can lock in excellent costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Sam Krier or one of their attentive representatives. Sam Krier can help design an insurance policy for the level of coverage you have in mind.

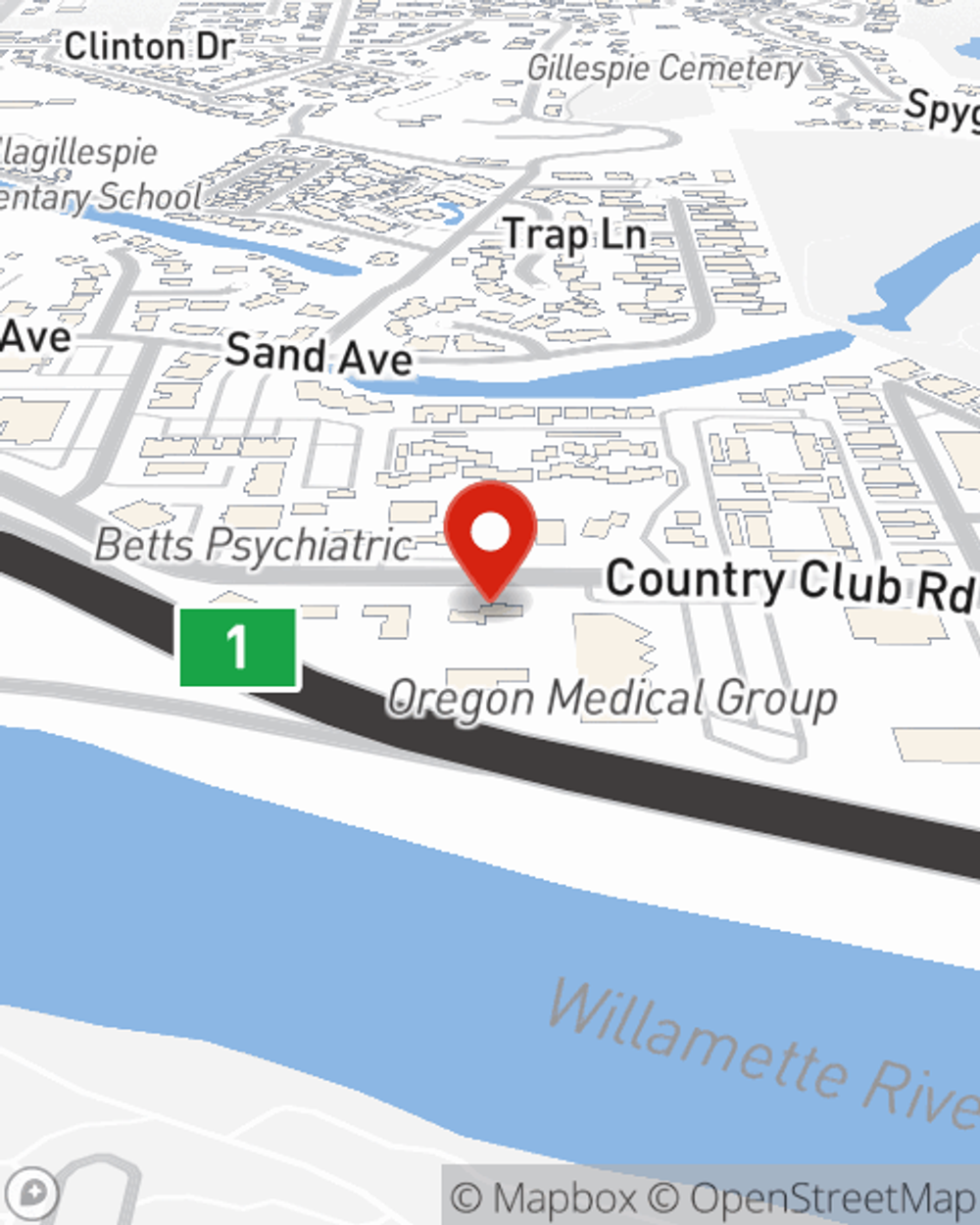

If you're a person, life insurance is for you. Agent Sam Krier would love to help you learn more about the variety of coverage options that State Farm offers and help you get a policy that works for you and your family. Visit Sam Krier's office to get started.

Have More Questions About Life Insurance?

Call Sam at (541) 780-6161 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Simple Insights®

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.